Taking a Private Company Public: The Journey of an Initial Public Offering (IPO) in India

Taking a private company public through an Initial Public Offering (IPO) is a complex journey involving multiple steps. In India, this transition goes beyond just raising funds; it marks a significant milestone that opens the door to substantial growth opportunities. By going public, companies can access capital markets, while investors gain a chance to become part of the company’s future.

However, the IPO process in India is far from straightforward. It requires meticulous planning, strict compliance with regulations, and a deep understanding of market dynamics. Whether you’re a business preparing to list or an investor eyeing upcoming IPOs, understanding how Indian companies navigate this transformation is essential. Below, we explore the key stages and strategies a company needs to adopt for a successful stock market debut.

What Is an IPO?

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, becoming publicly traded on a stock exchange. This enables companies to generate funds to grow their business, pay off loans, or finance new projects by issuing stock to shareholders. For investors, it’s an opportunity to buy shares and benefit from the company’s growth. The IPO symbolizes growth and transparency, marking a critical juncture in a company’s lifecycle.

Advantages and Disadvantages of an IPO

Advantages of an IPO

-

Access to Capital: IPOs allow companies to access substantial funds through the public sale of shares, enabling expansion into new markets, debt repayment, and further research.

-

Enhanced Credibility and Trust: Listing on a major stock exchange significantly improves a company’s image, fostering reliability among stakeholders, from customers to investors.

-

Liquidity for Early Backers: An IPO provides liquidity to existing shareholders, founders, and initial investors by allowing them to convert their ownership stakes into cash through share sales.

-

Recruiting Top Performers: Public firms can use stock options to attract and retain exceptional employees, a major benefit in today’s competitive landscape.

-

Growth via New Avenues: Access to public funding sources equips companies to pursue strategic acquisitions, enter emerging sectors, and rapidly scale operations.

- Increased Valuation: Companies trading on exchanges often command higher overall valuations due to marketplace belief and strong investor enthusiasm.

Disadvantages of an IPO

-

High Costs: IPOs involve significant expenses, including underwriting fees, legal costs, compliance charges, and marketing efforts, which can strain smaller companies.

-

Regulatory Burden: Public companies must comply with strict regulations, such as regular financial disclosures and audits, which can be time-consuming and expensive.

-

Loss of Control: Going public dilutes ownership, reducing the control of original shareholders. Decisions may now require board and shareholder approval.

-

Market Pressure: Public companies face immense pressure to deliver consistent quarterly performance, potentially prioritizing short-term gains over long-term strategy.

-

Risk of Volatility: Stock prices can be volatile, influenced by market trends, economic conditions, and investor sentiment, impacting the company’s valuation.

- Confidentiality Concerns: Public companies must disclose sensitive financial and operational details, which competitors can exploit.

Types of IPO

When a company decides to go public, it can choose between two primary types of Initial Public Offerings (IPOs): Fixed Price Offering and Book Building Offering. Each type caters to different investor preferences and market conditions.

Fixed Price Offering

In a fixed-price offering, the company establishes a single specific price at which shares will be accessible to the public. This price is revealed ahead of time in documentation. Buyers know precisely what each share will cost before applying. Demand is gauged only after the bidding period ends. While straightforward, this method risks pricing inaccuracies for the company, as the established price may not fully reflect marketplace appetite.

Book Building Offering

A Book Building IPO involves stipulating a range of prices with a minimum and maximum limit. Investors place orders within these bounds, specifying the quantity wanted and the price they are willing to pay. The final price, known as the cutoff price, is established based on demand. This dynamic approach delivers better pricing precision and economic efficiency, making it the more popular selection.

Eligibility Criteria for Companies to Launch an IPO

Launching an IPO is a significant milestone for a company, enabling capital collection and listing on stock markets. To ensure transparency and protect investors, the Securities and Exchange Board of India (SEBI) has stipulated certain criteria:

- Must be a public limited company under the Companies Act.

- Should have at least three years of operational track record.

- Minimum ₹3 crore net tangible assets in each of the past three years.

- Minimum ₹1 crore net worth in each of the past three years.

- Should have generated an average pre-tax profit of ₹15 crore in the last three years for main board IPO applications.

- The issue size should not exceed five times the company’s net worth unless using the Qualified Institutional Buyer (QIB) route.

- At least 1,000 public shareholders are required post-issue.

- Must have audited financial statements for the last three years.

- Promoters must contribute at least 20% of post-issue capital and lock it in for three years.

- No record of default or regulatory violations.

- Must have a functioning website with company and investor details.

- Must appoint SEBI-registered merchant bankers and other intermediaries.

Understanding The Need For IPO Process

During the IPO application process, a company transitions from a privately-held entity to a publicly-traded entity. Companies typically pursue an IPO to raise money and gain liquidity by offering their stocks to the public. They must adhere to the IPO process in India, as stipulated by stock exchanges, before their shares can be publicly traded. This process is often complicated and lengthy.

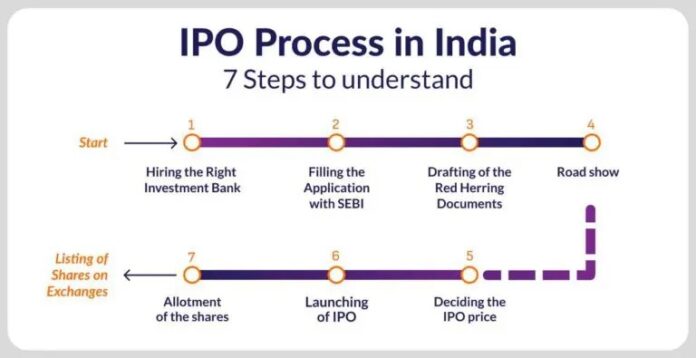

Steps for the IPO Allotment Process

Step 1: Hiring of an Underwriter or Investment Bank

To initiate the IPO process, the company engages financial experts, like investment banks. The underwriters assure the company about the capital being raised and act as intermediaries between the company and its investors. They study the crucial financial parameters of the company and sign an underwriting agreement.

Step 2: Registration for IPO

This step involves preparing a registration statement along with the draft prospectus, known as the Red Herring Prospectus (RHP). Submission of the RHP is mandatory, as per the Companies Act. This document comprises all compulsory disclosures as per SEBI and the Companies Act.

Step 3: Verification by SEBI

The market regulator, SEBI, verifies the disclosure of facts by the company. If the application is approved, the company can announce a date for its IPO.

Step 4: Making an Application to the Stock Exchange

The company must then apply to the stock exchange for floating its initial issue.

Step 5: Creating a Buzz by Roadshows

Before the IPO opens to the public, the company endeavors to create market buzz through roadshows. Over two weeks, executives promote the impending IPO across the country, sharing key highlights with potential investors.

Step 6: Pricing of IPO

The company can initiate pricing either through a Fixed Price IPO or a Book Building Offering. In a Fixed Price Offering, the stock price is announced in advance. In a Book Building Offering, a price range is announced, and investors can place bids within this bracket.

Step 7: Allotment of Shares

Once the IPO price is finalized, the company and underwriters determine the number of shares to be allotted to each investor. In the case of over-subscription, partial allotments will be made.

Important Documents in the IPO Process

Here is a list of IPO filing requirements:

- Draft Red Herring Prospectus (DRHP)

- Red Herring Prospectus (RHP)

- Prospectus

- SEBI Observation Letter

- Audited Financial Statements

- Due Diligence Report

- Board Resolution for IPO

- Shareholder Resolution

- Listing Agreement

IPO Timeline Overview

| Stage | Activity | Approximate Timeframe |

|---|---|---|

| Planning & Preparation | Appoint merchant bankers, legal advisors | 2–4 weeks |

| Due Diligence & Drafting | Prepare Draft Red Herring Prospectus (DRHP) | 3–6 weeks |

| Filing with SEBI | Submit DRHP to SEBI for review | Day 0 |

| SEBI Review & Comments | SEBI reviews and gives observations | 4–6 weeks |

| RHP Finalization | Update RHP and file with Registrar of Companies | 1–2 weeks after SEBI approval |

| Roadshows & Marketing | Promote IPO to investors | 1–2 weeks |

| IPO Opens | Investors apply for shares | 3–5 days |

| IPO Closes | Last day to submit bids | End of IPO window |

| Basis of Allotment | Shares allotted to applicants | Within 6 working days of close |

| Listing on the Stock Exchange | Shares listed and begin trading | 6–10 working days after close |

Conclusion

Now that you understand the IPO process and its importance, you can make informed decisions to invest in IPOs. Additionally, exploring upcoming IPO calendars can aid your understanding of the market. To make prudent investment decisions, it’s essential to select a trusted financial partner. Look for a stockbroking firm that offers smooth trading platforms, an all-in-one account for various investment options, and award-winning research to assist with the IPO subscription process.